With more than $step one.75 trillion when you look at the student loan debt in the usa, individuals was trying to find forgiveness options. However some forgiveness is offered in order to educators and you may societal servants from inside the particular ranking, these choices are unavailable to everyone, leaving of numerous looking a solution.

Student loans prohibit individuals off and then make significant life behavior, particularly investing in a downpayment getting a property. The good news is, consumers in search of homeownership can also enjoy an educatonal loan cash-aside refinance program. This choice has the benefit of property owners the flexibility to repay high-notice student education loans while you are probably refinancing so you can a lower life expectancy home loan appeal rate.

Although this program isn’t exactly a forgiveness program, it does create borrowers to help you wrap college loans and you will mortgage repayments toward an individual fee on a lesser interest rate.

Inside post, we break down so it student loan dollars-away re-finance program so you’re able to determine whether or perhaps not it is great to suit your situation.

What is actually a finances-Aside Re-finance Exchange?

Because 1970, average education loan personal debt has increased by more than three hundred per cent. That have an average of over $29,100000 inside the student loan loans for every graduate, it’s no surprise borrowers need education loan forgiveness programs. As well as the apps i listed above, the newest alternatives is emerging, such as for example county financial software that offer certain otherwise full loans recovery.

Probably one of the most prominent student loan recovery solutions is by using student loan bucks-away re-finance software. These types of programs are like a traditional cash-away refinance purchase, that enables financial proprietors to displace a classic home loan having a good new one that a more impressive number than simply owed into early in the day financing. This helps consumers fool around with their residence home loan to view dollars.

In the event you want to pay off student loans, a student loan cash-out refinance is basically just like a cash-aside re-finance program, nevertheless more income about the fresh new loan pays off college student loan personal debt.

Shows out-of Education loan Bucks-Out Re-finance Programs

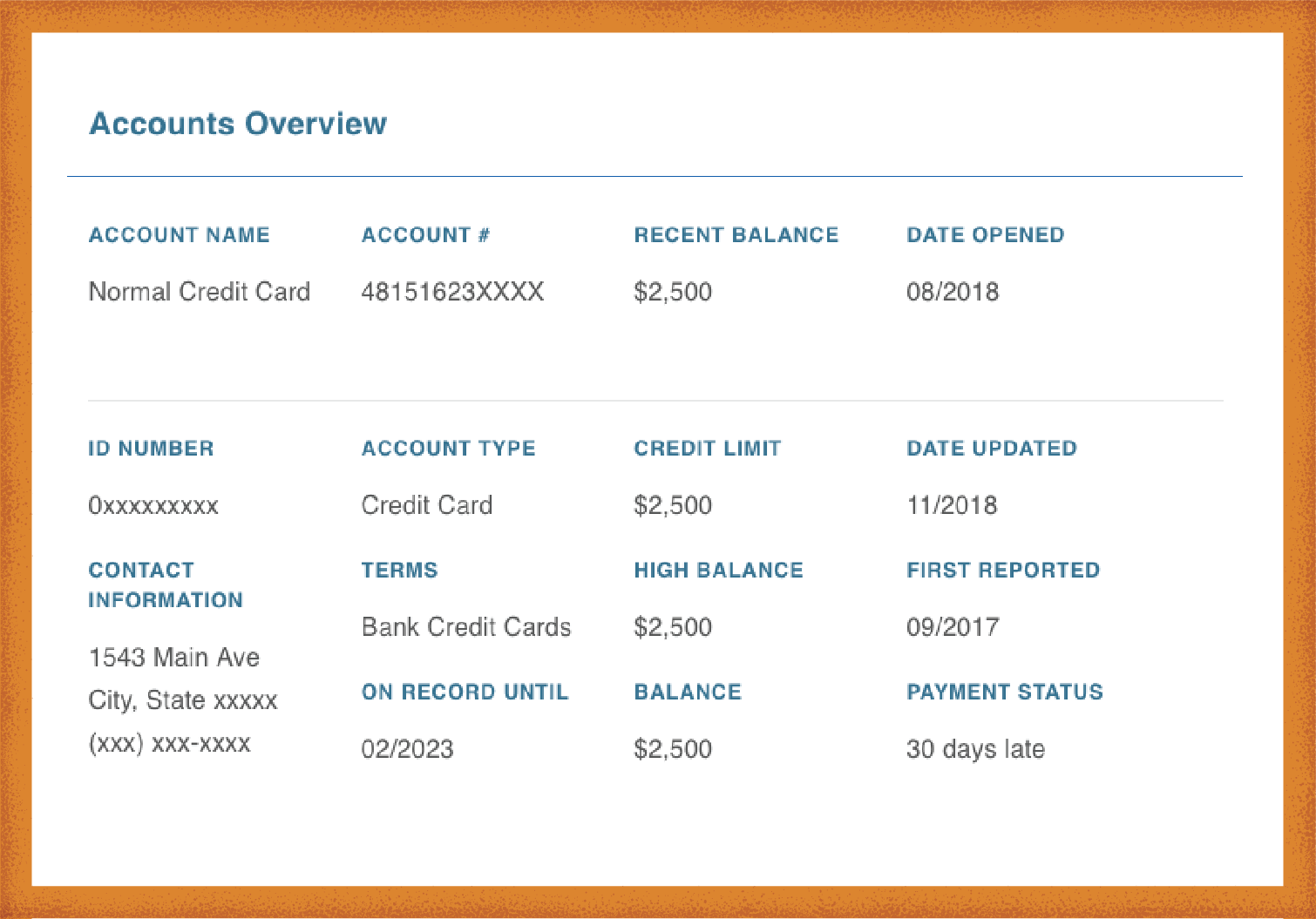

Education loan cash-aside re-finance applications create student loan guaranteed payday loans no teletrack direct lender loans repayment because of a property mortgage re-finance. Becoming eligible, one student loan have to be reduced because of the delivering financing into the education loan servicer within closure.

A lot more Uses of your Bucks-Out Re-finance

As the pri is to try to pay back student loan obligations, the mortgage may also be used various other ways. If the borrower does not want to settle the brand new totality out-of their student loans, capable always repay other mortgage-associated financial obligation. Such, borrowers may want to pay back:

- A current first-mortgage financing.

- Financing to fund will cost you toward an alternate build domestic.

- Settlement costs, items, and you can prepaid facts, excluding home taxation which can be more 60 days delinquent.

- Under liens familiar with buy the assets otherwise within the the new financial.

Additionally, the latest borrower ount isnt more than dos percent of one’s the new re-finance amount, or $2,one hundred thousand. The brand new borrower can be reimbursed by lender whenever they accrued overpayment off costs as a result of federal otherwise state rules otherwise regulations.

Facts

For the benefits of a student loan refinance program, the mortgage should be underwritten by the Desktop Underwriter (DU), a keen underwriting program one Federal national mortgage association often uses and, sometimes, new Government Houses Authority. Though DU cannot pick this type of deals, it can send a contact whether it appears that figuratively speaking is actually noted repaid from the closing. That it content will inform lenders of the loan standards, however the financial need concur that the loan matches every conditions outside of the DU.

Communicate with that loan Administrator In the Education loan Bucks-Aside Mortgage Standards

During the distance, do not imagine home buying must be tough. So we definitely don’t believe you will have to place your dreams of homeownership towards hold on account of student education loans.

When you are curious about more about education loan cash-out re-finance solutions-in addition to a student loan refinance system-reach out to one of our Financing Officials. They might be happy to leave you facts.